There are numerous forms of leases. The most common of these is the Triple Net lease. In a Triple Net lease, the tenant is responsible for their proportionate share of property taxes, property insurance, common operating expenses and common area utilities. Tenants are further responsible for all costs associated with their own occupancy including personal property taxes, janitorial services and all utility costs.

There are numerous forms of leases. The most common of these is the Triple Net lease. In a Triple Net lease, the tenant is responsible for their proportionate share of property taxes, property insurance, common operating expenses and common area utilities. Tenants are further responsible for all costs associated with their own occupancy including personal property taxes, janitorial services and all utility costs.

If the space is part of a larger building, the common area maintenance charges (CAMS) will be divided among the tenants of the building, generally based upon the tenant’s square footage percentage of the overall complex. In general, the landlord will be responsible for the structural integrity of a building.

NET LEASES

As with modified gross leases there are numerous forms of net leases. The most common of these is the Triple Net lease. In a Triple Net lease, the tenant is responsible for their proportionate share of property taxes, property insurance, common operating expenses and common area utilities. Tenants are further responsible for all costs associated with their own occupancy including personal property taxes, janitorial services and all utility costs.

This type of lease is rarely utilized in a multi-tenant office building. As with a modified gross lease, a modified net lease is also available. There are no set standards as to what costs may be excluded in a modified net lease; the lease is usually customized according to need.

Types of Net Leases

Net leases define the responsibilities of the landlord and the tenant differently. The following are types of net leases:

-

Single Net Lease – A single net lease is a net lease where the tenant agrees to pay a monthly lump sum base rent as well as the property taxes. The landlord is responsible for all other operating expenses of the premises.

-

Double Net Lease (NN) – A double net lease is a net lease where the tenant agrees to pay a monthly lump sum base rent as well as the property taxes and the property insurance. The landlord is responsible for all other operating expenses of the premises.

-

Triple Net Lease (NNN) – A Triple net lease is a net lease where the tenant agrees to pay a monthly lump sum base rent as well as the property taxes, the property insurance, and the maintenance. Under a triple net lease there are a few legal defenses which may relieve a tenant of his responsibilities. For example, a triple net lease may relieve the tenant of his responsibility if the property is subject to an eminent domain proceeding.

-

Absolute Triple Net Lease (Bond Lease) – An absolute triple net lease is a net lease where the tenant agrees to pay a monthly lump sum base rent as well as the property taxes, the property insurance, and the maintenance. Under an absolute triple net lease there are no legal defenses if a tenant fails to meet his responsibilities.

REALTECH is dedicated to providing the best investment commercial real estate and representing clients who are interested in purchasing commercial property. Interested in applying the philosophy of efficiency and business ethics in residential or commercial real estate business.

READ MORE…

Share this post:

PACENow is pleased to release the Lender Support Study, which surveyed national, regional and local mortgage lenders whose interests in buildings could be affected by PACE financings. PACE programs in Washington, D.C., Los Angeles, and San Francisco retained PACENow to develop and implement the survey, with grant support provided by the Urban Sustainability Directors Network.

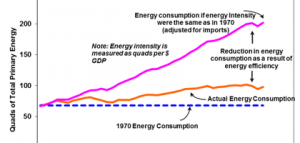

PACENow is pleased to release the Lender Support Study, which surveyed national, regional and local mortgage lenders whose interests in buildings could be affected by PACE financings. PACE programs in Washington, D.C., Los Angeles, and San Francisco retained PACENow to develop and implement the survey, with grant support provided by the Urban Sustainability Directors Network. U.S. energy use is approximately half of what it would have been if we had not improved our efficiency over the past 40 years. Still, there are large, cost-effective opportunities to increase energy efficiency much further, thereby helping us to cut energy bills, reduce pollution, and encourage economic growth.

U.S. energy use is approximately half of what it would have been if we had not improved our efficiency over the past 40 years. Still, there are large, cost-effective opportunities to increase energy efficiency much further, thereby helping us to cut energy bills, reduce pollution, and encourage economic growth.

There are numerous forms of leases. The most common of these is the Triple Net lease. In a Triple Net lease, the tenant is responsible for their proportionate share of property taxes, property insurance, common operating expenses and common area utilities. Tenants are further responsible for all costs associated with their own occupancy including personal property taxes, janitorial services and all utility costs.

There are numerous forms of leases. The most common of these is the Triple Net lease. In a Triple Net lease, the tenant is responsible for their proportionate share of property taxes, property insurance, common operating expenses and common area utilities. Tenants are further responsible for all costs associated with their own occupancy including personal property taxes, janitorial services and all utility costs. Clay summarizes the current status of the PACE program, its program benefits to the property owners, and the Prologis case study that closed in San Francisco in November, 2012.

Clay summarizes the current status of the PACE program, its program benefits to the property owners, and the Prologis case study that closed in San Francisco in November, 2012.

As part of Energy Upgrade California, owners of non-residential commercial properties in Los Angeles County have access to an innovative financing mechanism to fund up to 100% of the cost of building performance upgrades—Property Assessed Clean Energy (or PACE) financing.

As part of Energy Upgrade California, owners of non-residential commercial properties in Los Angeles County have access to an innovative financing mechanism to fund up to 100% of the cost of building performance upgrades—Property Assessed Clean Energy (or PACE) financing.